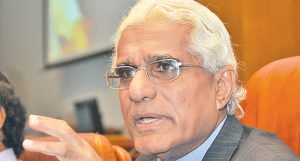

The IMF bailout or restructuring whatever you may call it will role on whichever government is in power and many are interested to find out what its impact and process will be. Here are five key points made by Dr Dushni Weerakoon, Institute of Policy Studies and Dr Indrajit Coomaraswamy, Former Governor of the Central Bank.

The five key points from the article “The IMF, Debt Restructuring and Fiscal Reforms: What to Expect and What to Prioritize” by Dr Dushni Weerakoon and Dr Indrajit Coomaraswamy, published in Echelon.lk:

1. Fiscal reforms are crucial for Sri Lanka’s economic recovery, but they will be painful. Both Dr. Weerakoon and Dr. Coomaraswamy emphasize the importance of fiscal reforms to address Sri Lanka’s high budget deficits and unsustainable debt levels. However, they acknowledge that these reforms, such as raising taxes and freezing public sector wages, will be difficult and require careful communication to avoid social unrest.

2. Debt restructuring is inevitable, but it will be a complex process. Dr Coomaraswamy argues that due to Sri Lanka’s high debt levels and limited options, some form of debt restructuring is unavoidable. This will involve negotiations with various creditors, including private bondholders, bilateral lenders like China and India, and multilateral institutions. Dr. Weerakoon highlights the potential risks of this process, such as prolonged negotiations, legal challenges, and reputational damage.

3. The order of reforms is critical. Dr. Weerakoon emphasizes the need for simultaneous action on fiscal, monetary, and exchange rate fronts to achieve stability. She argues that prioritizing fiscal reforms is crucial, even though it is politically challenging. Dr. Coomaraswamy concurs, stating that fiscal reform must be at the centre of any attempt to overcome the economic crisis.

4. Inflation and exchange rate are major concerns. Both economists express concern about rising inflation and a volatile exchange rate. Dr. Weerakoon believes that current inflationary pressures stem primarily from supply-side disruptions, but warns of the risk of a wage-price spiral if not addressed. Dr. Coomaraswamy emphasizes the importance of rebuilding foreign reserves to stabilize the exchange rate.

4. Inflation and exchange rate are major concerns. Both economists express concern about rising inflation and a volatile exchange rate. Dr. Weerakoon believes that current inflationary pressures stem primarily from supply-side disruptions, but warns of the risk of a wage-price spiral if not addressed. Dr. Coomaraswamy emphasizes the importance of rebuilding foreign reserves to stabilize the exchange rate.

5. IMF support is important but contingent on debt sustainability. Dr. Coomaraswamy highlights the Catch-22 situation: Sri Lanka needs an IMF program for debt restructuring, but the IMF cannot support a country with unsustainable debt. Both economists emphasize the need for a comprehensive debt sustainability analysis and negotiations with creditors to pave the way for IMF support